Pakistan’s total fiscal revenue has nearly doubled over the last two years, surging from Rs. 9.6 trillion to almost Rs. 18 trillion, according to fresh data from the International Monetary Fund (IMF).

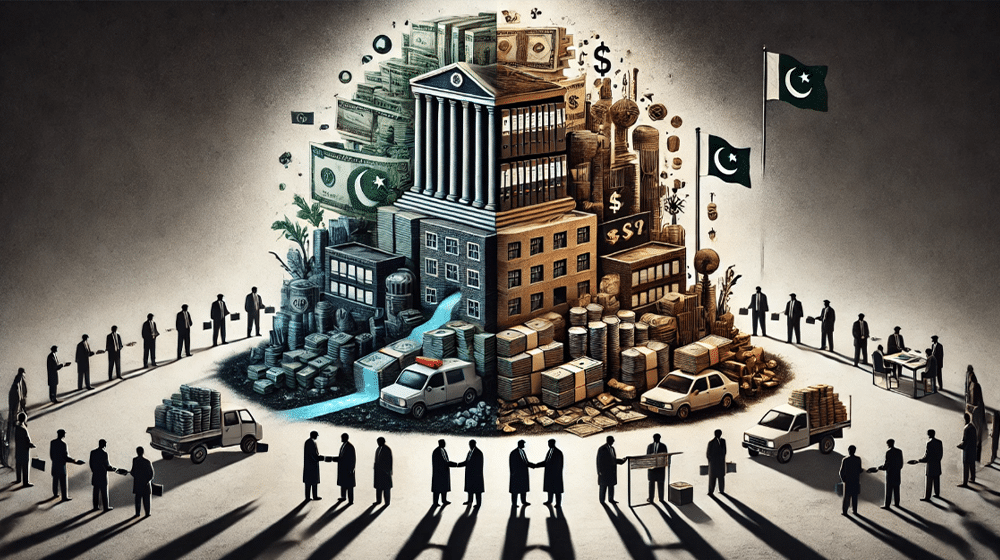

The Finance Ministry attributes this jump to improved tax collection, new levies, and central bank support every fiscal year, but this rise masks deeper structural problems in our tax regime. “The increase is largely cosmetic, achieved through repeated hikes in existing tax rates pushed largely through new budgets every June. The tax base has remained idle throughout this period,” an Islamabad-based investment banker told ProPakistani.

Unfortunately, I also believe the tax base has remained largely unchanged in the past 24 months while tax rates have become nothing short of behemoth.

Commentators on X say this isn’t a turnaround but a burden shift. “Electricity bills have doubled, and that means more taxes. Salary taxes have doubled. But these are already documented sectors. The base hasn’t expanded at all,” an expert said in a text last week.

The IMF has endorsed Pakistan’s fiscal growth but this very acknowledgement has raised questions everywhere. “It amazes me why the IMF doesn’t push for real reforms,” the banker added.

He argued, “Why hasn’t track-and-trace been fully implemented? Why aren’t CEOs and CFOs required to certify the correctness of company accounts through FBR? FBR tried, but it was forced to retreat. Off-book transactions continue unchecked.”

According to Topline Securities, the government might extend the exemption limit on salary or reduce tax rate by 2.5 percent for all salary brackets. It could promulgate inflation-adjusting minimum wages and some cuts in super tax, but everything is dependent on the IMF.

The government is eyeing Rs. 150 billion new taxes on biscuits, chips and other packaged food, Rs. 600 billion on online content creators, a Rs. 5 per liter hike in petroleum levy on petrol and diesel to make up to Rs. 80 billion more in tax revenue, and a stricter regime to squeeze out Rs. 295 billion from retailers. More of this stuff, but it shows it’s always more taxes and no reform.

I may be wrong, but I think such superficial gains risk undermining the credibility of future FBR reforms. People on X have strongly worded arguments that FBR’s performance is being manipulated by taxing the same, already-documented sectors more heavily, not by bringing untaxed sectors into the net but ripping off the current base to report higher revenue.

Despite the robust headline figures, the upcoming FY26 budget may target slower tax growth, which could ease economic pressure. Still, without genuine structural changes and IMF support, next fiscal year will be more tough for the salaried class.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of ProPakistani. The content is provided for informational purposes only and is not intended as professional advice. ProPakistani does not endorse any products, services, or opinions mentioned in the article.

About the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.

Verified Professional

25+ Years Experience