The National Assembly on Thursday passed the Rs. 17.6 trillion federal budget for 2025-26 along with Rs. 463 billion in new taxes.

The budget introduces taxes on digital platforms, foreign vendors, streaming services, e-commerce, and cash-on-delivery transactions. A new climate levy of Rs. 2.5 per litre has been imposed on petrol and diesel.

A tax of 1 to 3 percent has been introduced on fuel-based vehicles to subsidize electric vehicles. Pensions exceeding Rs. 10 million annually will be taxed at 5 percent.

A 10 percent sales tax has been approved on imported solar panels.

The government has significantly diluted its key enforcement tool that aimed to ban economic transactions by non-filers. Now, restrictions will only apply if residential property is worth over Rs. 50 million, commercial property over Rs. 100 million, or car purchases exceed Rs. 7 million.

Non-filers will not be allowed to maintain savings accounts or withdraw more than Rs. 100 million in cash per year. Restrictions on stock market investments apply only above Rs. 50 million annually.

The largest budgetary allocation is Rs. 8.2 trillion for interest payments. Defence spending is set at Rs. 2.55 trillion, excluding pensions and development and civil government expenses of Rs. 917 billion.

The National Assembly has also retained the FBR’s arrest powers in sales tax fraud cases but introduced new safeguards.

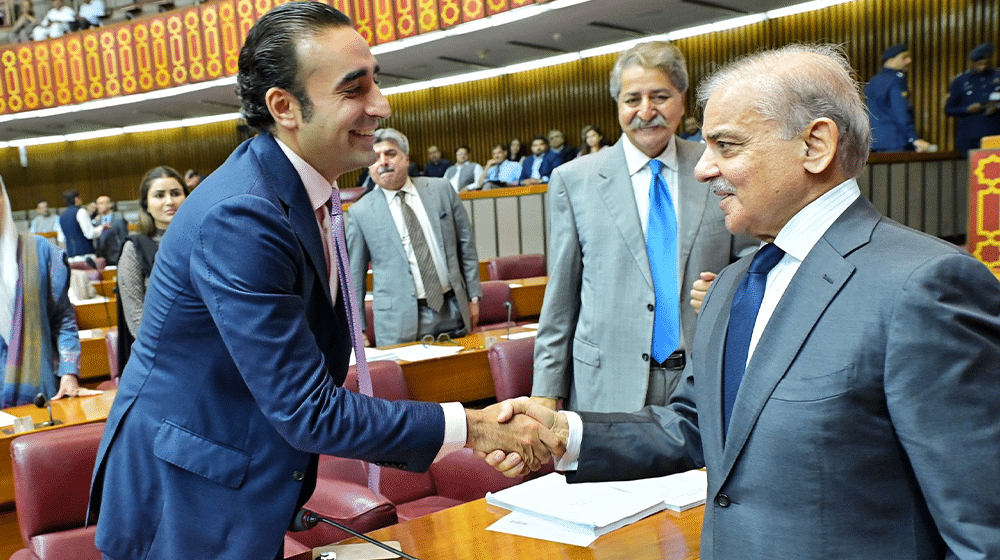

PM Shehbaz’s coalition partners supported the budget after claiming the government accepted their demands, including exempting salaried individuals earning Rs. 100,000 per month.

The income tax rate on the debt portion of mutual funds issued to companies has been raised from 25 to 29 percent. Income from loans to the government will now be taxed at 20 percent, up from 15 percent. A withholding tax exemption was approved for individuals selling residential property after holding it for at least 15 years.

The Finance Act 2025 will come into effect from July 1.

About the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.

Verified Professional

25+ Years Experience