In the dynamic landscape of Pakistan's tax regulations, encountering notices from the Federal Board of Revenue (FBR) is an almost inevitable reality for businesses. Among these, a Section 182 Default Surcharge Notice can cause significant concern due to its direct implications on financial operations. Understanding the intricacies of these notices, your payment options, and the crucial appeal process is paramount for any business owner, tax professional, or corporate decision-maker aiming to maintain compliance and mitigate financial risks. This guide provides a deep dive into Section 182 of the Income Tax Ordinance, 2001, offering actionable insights and a clear roadmap for handling these notices effectively.

Why Section 182 Default Surcharge Notices Matter Now

The current economic climate in Pakistan places a heightened emphasis on tax compliance and revenue collection. As the FBR intensifies its efforts to broaden the tax base and ensure timely payment of taxes, the issuance of default surcharge notices is becoming more frequent and stringent. A Section 182 notice signifies that the FBR has identified a default in tax payment, leading to the imposition of a surcharge. Prompt and accurate response is not just a matter of avoiding penalties; it's about safeguarding your business's reputation, operational continuity, and financial health. Ignoring such a notice can lead to escalated penalties, attachment of assets, and legal proceedings, making proactive management of this issue essential.

Important Note:

Section 182 of the Income Tax Ordinance, 2001, deals with the imposition of a surcharge for default in payment of tax. This means that if you fail to pay your assessed tax liability by the due date, the FBR is empowered to charge a default surcharge in addition to the principal tax amount.

Understanding the Section 182 Default Surcharge

At its core, Section 182 is a penalty provision designed to incentivize timely tax payments. It acts as a deterrent against delaying tax obligations. The surcharge is typically calculated as a percentage of the unpaid tax for each month or part of a month the tax remains unpaid.

What Triggers a Section 182 Notice?

Several scenarios can lead to the issuance of a Section 182 Default Surcharge Notice. Understanding these triggers is the first step in prevention:

- Failure to pay self-assessed tax: If you file your tax return but fail to pay the self-assessed tax liability by the due date.

- Default in payment of demand raised by FBR: If the FBR issues an assessment order or a demand notice and you fail to pay the demanded amount within the stipulated period.

- Non-payment of tax deducted at source (Withholding Tax): If taxes deducted from payments to third parties are not deposited with the government by the due date. This is a common area where businesses overlook timely deposit.

- Delay in payment of advance tax: If installments of advance tax are not paid according to the prescribed schedule.

How is the Default Surcharge Calculated?

The calculation of the default surcharge is crucial for understanding the quantum of the liability. Section 182(1) of the Income Tax Ordinance, 2001, stipulates:

"Where any amount of tax, penalty or any other sum due under this Ordinance is not paid by the due date, the person responsible for such payment shall, in addition to such tax, penalty or other sum, pay thereon a surcharge at the rate of - (a) one and a half per cent per month or part of a month, from the due date of payment of tax, penalty or other sum to the date of its actual payment; or (b) one and a half per cent per month or part of a month, on the amount of tax payable, as the case may be, from the date the tax was due to the date of its actual payment."

In plain language: The surcharge is calculated at 1.5% per month (or any part thereof) on the amount of tax that was due but not paid, from the original due date until the date of actual payment.

Practical Example of Surcharge Calculation:

Let's say your business, 'Alpha Enterprises', had a tax liability of PKR 500,000 due on March 31, 2024. However, payment was delayed until May 15, 2024.

- Principal Tax Due: PKR 500,000

- Period of Default: April 2024 (1 month) + May 2024 (part of a month) = 2 months.

- Monthly Surcharge Rate: 1.5%

- Monthly Surcharge Amount: 1.5% of PKR 500,000 = PKR 7,500

- Total Default Surcharge: PKR 7,500 x 2 months = PKR 15,000

- Total Amount Payable: PKR 500,000 (Principal Tax) + PKR 15,000 (Surcharge) = PKR 515,000

Cost Implications:

The surcharge directly increases the total tax burden. Over extended periods of default, this additional cost can become substantial, impacting profit margins and cash flow. It is therefore critical to settle tax liabilities as soon as they are identified.

Payment Options for Section 182 Default Surcharge Notices

Once you receive a Section 182 notice, understanding your payment options is crucial for prompt resolution. The FBR provides several avenues for making these payments:

1. Full Payment of Principal Tax and Surcharge

The most straightforward and recommended option is to pay the entire amount demanded in the notice, which includes the principal tax amount (if any remains unpaid) and the calculated default surcharge. This is the quickest way to clear your default and avoid further penalties.

How to Pay:

- Obtain the Correct Challan: You will need to use the appropriate revenue receipt (challan) form. For income tax, this is typically Form 'C'.

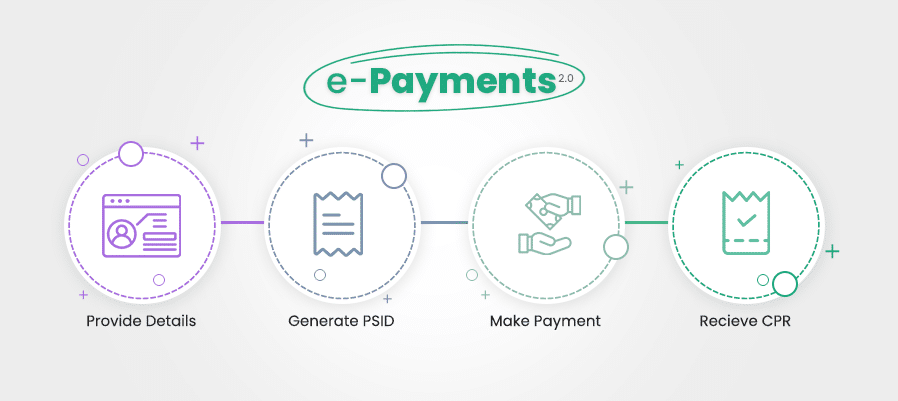

- Generate Challan Online: The FBR's Iris portal (e-filing.fbr.gov.pk) allows you to generate challans online. Navigate to the relevant payment section and select the appropriate tax type and purpose.

- Visit Authorized Banks: Alternatively, you can visit any designated bank branch (e.g., National Bank of Pakistan, State Bank of Pakistan, or other commercial banks authorized by the State Bank of Pakistan) with the challan.

- Specify Payment Details: Ensure you accurately enter your National Tax Number (NTN), the relevant tax year, the type of tax, and the amount being paid. For default surcharge, it should be clearly indicated as such on the challan.

- Obtain Proof of Payment: Always keep the stamped copy of the challan as proof of payment.

Timeline Estimate:

Online challan generation is instantaneous. Payment at bank branches usually takes a few hours on the same day. Once paid, the credit to your tax account may take 1-3 business days.

2. Request for Amnesty or Installment Plan (Limited Scope)

While not a standard provision for default surcharge, in specific circumstances, particularly during government-announced tax amnesties or on a case-by-case basis for genuine hardship, taxpayers might petition the FBR for a waiver of penalty or an installment plan for outstanding tax and surcharge. This is highly discretionary and not guaranteed.

Process for Petitioning:

- Formal Application: Draft a formal application to the Commissioner Inland Revenue (CIR) or the relevant FBR authority.

- State Reasons: Clearly explain the reasons for the default and the financial hardship faced by the business. Substantiate your claims with supporting financial documents.

- Propose a Plan: If requesting installments, propose a realistic payment schedule.

- Submit to the Relevant Tax Office: File the application with the jurisdictional Commissioner Inland Revenue.

Pro Tip:

Such requests are usually more successful when accompanied by a sincere commitment to future compliance and a clear demonstration of financial distress. Engaging a tax consultant can significantly improve the chances of a favorable outcome.

3. Appealing the Default Surcharge Notice

If you believe the notice is incorrect, either in the calculation of the surcharge or the underlying tax liability, you have the right to appeal. This is a critical recourse that should be explored thoroughly.

The Appeal Process for Section 182 Notices

The appeal process against an FBR notice involving default surcharge typically follows the established tax appeal hierarchy in Pakistan. It's a multi-stage process that requires careful adherence to timelines and procedures.

Stage 1: Filing an Appeal with the Commissioner Inland Revenue (Appeals)

If you disagree with the assessment or the notice issued by the Assessing Officer, the first step is to file an appeal with the Commissioner Inland Revenue (Appeals) (CIR-A).

Requirements for Filing:

- Time Limit: The appeal must be filed within 30 days of the date of receipt of the notice or order you are appealing against.

- Form of Appeal: The appeal should be in writing, clearly stating the grounds of appeal. While there isn't a prescribed specific form for Section 182 notices, it should be structured formally.

- Grounds of Appeal: Clearly articulate why you believe the notice or the surcharge is incorrect. This could be due to factual errors, misinterpretation of law, or incorrect calculation.

- Supporting Documents: Attach copies of the notice, relevant assessment orders, payment proofs (if you've paid part of it), and any other supporting documentation.

- Pre-payment of Admitted Tax: Generally, under Section 127 of the Income Tax Ordinance, 2001, you are required to pay 50% of the admitted tax liability (or the amount not disputed) before filing an appeal with the CIR-A. This is a crucial condition.

Procedure:

- Draft the Appeal Memorandum: Prepare a detailed memorandum outlining each ground for appeal with supporting arguments.

- Gather Evidence: Collect all relevant documents, records, and correspondence.

- File the Appeal: Submit the appeal memorandum and supporting documents to the office of the jurisdictional CIR-A.

- Hearing: The CIR-A will schedule a hearing where you or your authorized representative can present your case.

Common Mistake to Avoid:

Incorrect Calculation of Admitted Tax: Many taxpayers miscalculate the 50% admitted tax requirement, leading to the rejection of their appeal. Ensure you correctly identify the undisputed portion of the tax liability and pay 50% of that amount.

Stage 2: Appeal to the Appellate Tribunal Inland Revenue (ATIR)

If you are dissatisfied with the order passed by the CIR-A, you can file a further appeal to the Appellate Tribunal Inland Revenue (ATIR).

Requirements for Filing:

- Time Limit: The appeal must be filed within 60 days of the date of receipt of the order from the CIR-A.

- Form of Appeal: A prescribed form is usually available or required for ATIR appeals.

- Supporting Documents: Include copies of the order being appealed against, the order from the CIR-A, and all relevant previous submissions and evidence.

- Pre-payment of Admitted Tax: Similar to the CIR-A stage, there might be requirements for pre-payment of admitted tax or a portion thereof as stipulated by law or the tribunal's rules.

Procedure:

- File Appeal with ATIR: Submit the appeal along with prescribed fees and supporting documents.

- Tribunal Hearing: The ATIR will hear the case, which can involve legal arguments and presentation of evidence.

Stage 3: High Court and Supreme Court

Further appeals lie to the High Court (on questions of law) and then to the Supreme Court of Pakistan.

When to Consider Appealing?

Appealing is a serious undertaking and should not be initiated lightly. Consider an appeal if:

- The surcharge is calculated on an incorrect tax amount.

- The tax demand itself is disputed and being appealed separately.

- There was a genuine error on the part of the FBR, such as incorrect information on record.

- The surcharge was applied due to circumstances beyond your control (though this is difficult to prove).

Case Study: Alpha Enterprises' Appeal Success

Scenario: Alpha Enterprises received a Section 182 notice for PKR 50,000 for a tax year where they had already paid the full tax liability but the FBR's system did not reflect the payment. The notice calculated a surcharge of PKR 5,000.

Action: Alpha Enterprises immediately gathered proof of their tax payment (stamped challan) and filed an appeal with the CIR-A within the 30-day window, attaching the payment proof. They paid the disputed tax amount (zero in this case) to fulfill the pre-payment requirement for admitted tax.

Outcome: The CIR-A reviewed the evidence, confirmed the earlier payment, and cancelled the default surcharge notice. This prevented an unnecessary financial outflow and the associated administrative burden.

Impact: By taking prompt and correct action, Alpha Enterprises avoided paying an unwarranted PKR 5,000 surcharge and maintained a clean compliance record.

Preventive Measures: Avoiding Section 182 Notices

The best approach to dealing with Section 182 notices is to prevent them from being issued in the first place. Here are key strategies:

- Timely Tax Payments: Ensure all tax liabilities, including advance tax installments, self-assessed tax, and withholding taxes, are paid by their respective due dates.

- Accurate Record Keeping: Maintain meticulous records of all tax payments, including challan numbers, dates, and amounts.

- Reconciliation: Regularly reconcile your tax payments with your tax filings and the FBR's records (available on the Iris portal).

- Understanding Due Dates: Be fully aware of all statutory due dates for tax payments and filings. Mark them prominently in your business calendar.

- Proactive Communication with FBR: If you foresee a delay in payment, contact your tax advisor and potentially communicate with the FBR well in advance, although this does not waive the surcharge obligation.

- Regular Tax Audits: Conduct internal tax audits or engage tax professionals for regular reviews to identify potential compliance gaps before they lead to notices.

Action Items Checklist:

- [ ] Verify all tax payment due dates for the current and upcoming tax periods.

- [ ] Ensure timely deposit of all withholding taxes deducted.

- [ ] Reconcile tax payments with FBR's Iris portal at least quarterly.

- [ ] Keep digital and physical copies of all tax challans and payment confirmations.

- [ ] Consult with your tax advisor on any complex tax payment scenarios.

Legal and Regulatory Updates Relevant to Section 182

The Finance Acts introduced annually can sometimes amend provisions related to surcharges or penalties. It's crucial to stay updated with these changes. For instance, while the core of Section 182 remains, amendments in the Finance Act could alter the surcharge rate or introduce specific conditions.

Disclaimer: Tax laws are subject to frequent changes. Always refer to the latest Finance Act and FBR notifications for the most current information. The rates and procedures mentioned are based on the Income Tax Ordinance, 2001, as generally understood, but specific situations may require expert interpretation.

Where to Find Official Information:

- FBR Iris Portal: For online challan generation, tax account reconciliation, and viewing notices: e-filing.fbr.gov.pk

- FBR Website: For circulars, notifications, and the Income Tax Ordinance, 2001: fbr.gov.pk

Frequently Asked Questions (FAQs)

Q1: Can the default surcharge be waived entirely?

A1: While complete waiver of the default surcharge is rare, it might be considered by the FBR authorities under exceptional circumstances of genuine hardship or if the default was due to FBR's own error. A formal application with strong supporting evidence is required. It's not a guaranteed outcome.

Q2: What happens if I don't pay the default surcharge after receiving the notice?

A2: Failure to pay the acknowledged default surcharge or to appeal it within the prescribed time can lead to further enforcement actions by the FBR. This could include penalties under other sections of the Income Tax Ordinance, attachment of bank accounts or assets, and legal proceedings to recover the outstanding amount, including the accrued surcharge.

Q3: Can I deduct the default surcharge as a business expense?

A3: Generally, penalties and surcharges imposed by tax authorities for non-compliance are not considered deductible business expenses under the Income Tax Ordinance, 2001. They are typically treated as a cost of non-compliance.

Conclusion

Receiving a Section 182 Default Surcharge Notice is a serious matter that demands immediate attention and a strategic response. By understanding the basis of the surcharge, your available payment options, and the detailed appeal process, you can effectively manage such situations. Proactive compliance, meticulous record-keeping, and timely action are your best defenses against the imposition and escalation of default surcharges. For complex cases or when facing significant financial implications, seeking expert advice from a qualified tax professional or consultant in Pakistan is highly recommended.

Explore Our Services

View all servicesAbout the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.