The Pakistan Business Council (PBC) has issued an early warning on the far-reaching implications of the United States’ newly imposed 29 percent reciprocal tariff on Pakistani exports.

It said these tariffs could seriously dent the country’s external account unless urgent structural and policy reforms are undertaken.

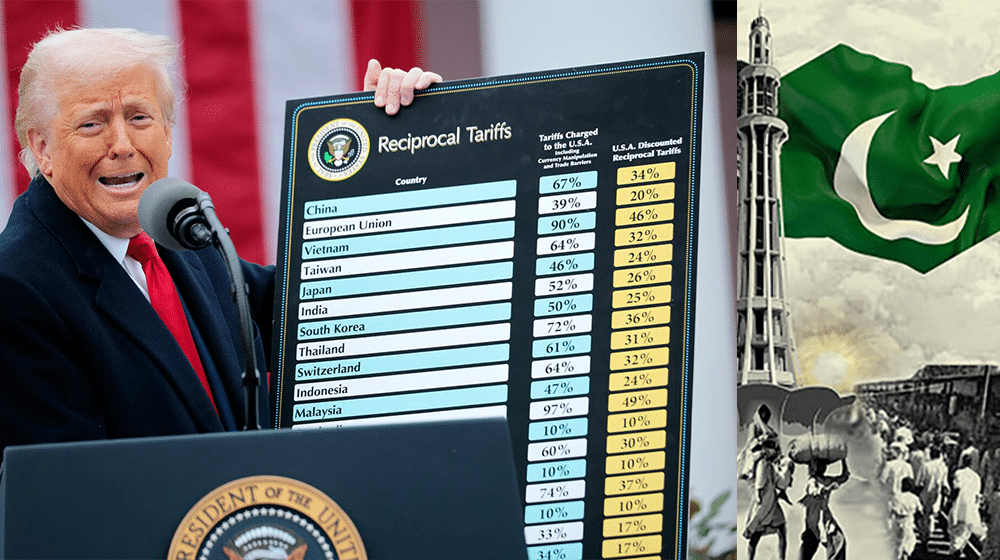

In its initial analysis following President Donald Trump’s April 2 announcement, PBC underscored that the US is Pakistan’s largest single-country export destination, accounting for $5.46 billion or 17 percent of total exports in 2024. Despite this significance for Pakistan, its share in US imports remains minuscule at just 0.16 percent.

Textiles and apparel, which comprise 75 percent of Pakistan’s exports to the US, formed only 3 percent of American imports of such goods.

While the headline 29 percent tariff has alarmed Pakistani exporters, PBC noted that tariffs on Pakistan’s key competitors are even higher: China at 54 percent, Vietnam 46 percent, Bangladesh 37 percent, and Indonesia 32 percent. However, India’s rate stands lower at 26 percent. “Despite this relative advantage, Pakistan cannot immediately pivot its export strategy to capitalize on this tariff differential,” PBC cautioned, pointing to qualitative product gaps and higher unit prices commanded by rival countries.

The council advised against retaliatory countermeasures, stating that Pakistan lacks both economic and geopolitical leverage. Instead, it recommended immediate focus on sustaining duty-free access to the EU under the GSP+ scheme, which has become even more critical amid declining US market viability. “Exporters must maintain strict compliance on human rights, labor laws, and environmental protection to retain GSP+ benefits,” it said, warning against complacency, particularly on ESG and DEI standards.

PBC suggested that rising prices in the US might push some buyers to opt for cheaper goods from Pakistan. However, the broader outlook remains challenging, particularly as US buyers shift preference toward man-made fibers while Pakistan’s advantage historically lies in cotton-based products.

PBC also urged the government to urgently address domestic policy bottlenecks, including energy tariffs and the taxation regime. The ongoing review of the Export Facilitation Scheme must ensure uninterrupted and duty-free access to inputs for exporters, the note stressed. “Restoring GST exemptions for local suppliers of export inputs is essential,” it added.

The US has also indicated possible tariff relief on goods with a minimum 20 percent US-origin content, such as textiles made with US cotton. However, the PBC flagged price competitiveness as a concern, noting that US cotton is currently 10 to 12 cents per pound costlier than Brazilian cotton.

Meanwhile, the possibility of Pakistan shifting major imports to the US to improve its trade balance appears limited. US exports to Pakistan in 2024 totaled $2.13 billion, comprising mainly of cotton, scrap iron, machinery, and aircraft parts. Key sectors like meat and soybeans, previously hindered by regulatory hurdles, may see some activity, but broader investment interest from the US remains subdued, with no significant moves in areas like power generation, aviation, or infrastructure.

PBC warned that as global exports to the US falter under new tariffs, Pakistan may face a wave of cheap product dumping, especially due to its underpowered anti-dumping enforcement. “This is a wake-up call. Pakistan must strengthen its trade defense mechanisms urgently,” the council concluded.

A more detailed analysis from the PBC is expected in the coming days.

About the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.

Verified Professional

25+ Years Experience