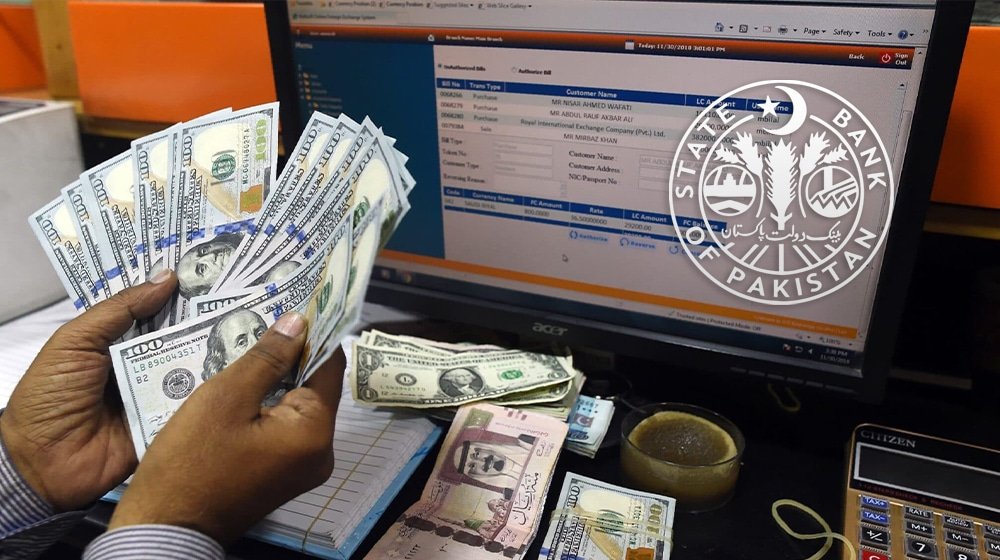

The State Bank of Pakistan has directed exchange companies to begin using facial recognition for customer verification in addition to thumb and fingerprint scans, introducing a dual biometric system to strengthen security and transparency in foreign exchange transactions.

According to an SBP circular, the Ministry of Interior and Narcotics Control has instructed that facial recognition be incorporated into all biometric verification services obtained through Nadra.

The new requirement will take effect from January 1, 2026.

The central bank has advised exchange companies to put in place the necessary administrative and technical measures to ensure timely compliance.

Officials from exchange companies said they already use Nadra’s real-time system to verify customer thumbprints and fingerprints before processing any foreign exchange transaction, as mandated by the SBP. Companies are also required to keep CCTV footage for six months.

The addition of facial recognition aims to create a uniform and more secure verification process and reduce the risk of identity fraud in the currency market.

About the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.

Verified Professional

25+ Years Experience