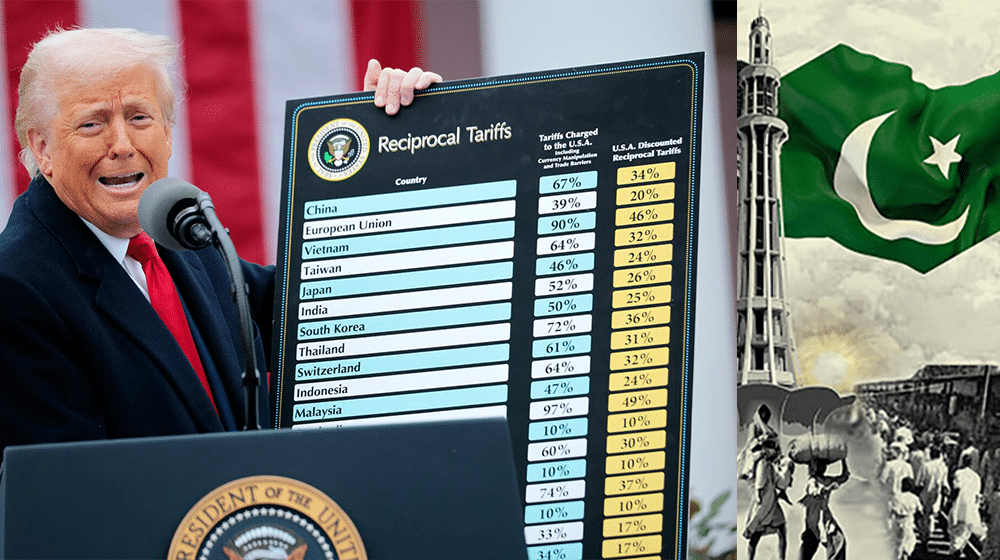

In the wake of the escalating global tariff war, Pakistan stands to gain substantial economic relief and save over $2 billion in import bill due to a significant drop in commodity prices, particularly crude oil, RLNG, and coal.

In the aftermath of the tariff war initiated by the US and retaliated by other nations, the Bloomberg commodity index has declined by 8 percent in the last three sessions. Within this, crude oil prices (Brent) and Richards Bay coal futures (April) are down by 14.3 percent to US$64.2 per barrel and 6.1 percent to US$88.5 per ton, respectively.

Topline noted that the falling commodity prices will impact Pakistan’s macroeconomic indicators, including external accounts, primarily the current account, inflation, and fiscal accounts, among others. For instance, if oil prices decline by US$10 per barrel, this would reduce the oil-related import bill (including RLNG) by US$2-2.1 billion. In addition to oil, Pakistan can also save US$250-300 million annually from coal, LPG, and palm oil if lower levels of prices persist. Oil prices also affect inflation directly, and with a US$10 per barrel decline in oil, inflation would be directly impacted by 20 basis points, assuming the benefit is passed on to consumers. The details are outlined below:

These three commodities can save US$2-2.1 billion of Pakistan’s imports, which accounts for 3.5-4 percent of Pakistan’s total imports. Additionally, savings of around US$150-200 million can also be achieved through other imports such as palm oil (US$3 billion total imports) and LPG (US$1 billion total imports), due to their direct/indirect link to oil prices.

Pakistan Market to Remain Stable Amidst IMF Program

Currently, oil prices are well above the 2016 prices (when they fell below US$40), so the report doees not expect any significant impact on remittances. In the worst-case scenario, a 5 percent decline in Gulf remittances could reduce overall remittances by 2.7 percent or US$1 billion.

The report maintains its base case index target of 127,000 for December 2025. However, with higher liquidity, the index could surpass the 150,000 mark, assuming successful IMF reviews and political stability.

About the Author

Written by the expert legal team at Javid Law Associates. Our team specializes in corporate law, tax compliance, and business registration services across Pakistan.

Verified Professional

25+ Years Experience